In Short

- Vet Franchisees Thoroughly – Assess resumes, references, financial stability, and past experience to ensure candidates align with your brand’s standards.

- Use Legal and Financial Protections – Secure interests through legal agreements, financial checks, and compliance with franchising laws.

- Leverage Research and Expert Advice – Conduct online research, in-depth interviews, and engage professional advisors to mitigate risks and safeguard your franchise network.

Tips for Businesses

Thorough due diligence is crucial when selecting franchisees. Review financial stability, legal history, and business experience. Conduct interviews and request business plans to ensure candidates are prepared for success. Use legal protections like guarantees and PPSR checks. Seeking expert advice early can prevent costly mistakes and protect your brand’s reputation.

On this page

- 1. Assess Resumes and References Thoroughly

- 2. Conduct a Detailed Financial Analysis

- 3. Secure Your Interests with Proper Legal Protection

- 4. Leverage Online Research for Additional Insights

- 5. Conduct In-Depth Interviews

- 6. Request a Comprehensive Business and Marketing Plan

- 7. Engage Professional Advisors

- 8. Evaluate Previous Work and Relevant Experience

- Key Takeaways

- Frequently Asked Questions

In franchising, success hinges on preparation and informed decision-making. As a franchisor, the choices you make today will shape your brand’s future and can directly impact its reputation, profitability and long-term viability. Selecting the right franchisees is not just about expanding your network; it is about safeguarding the integrity of your brand and ensuring consistent performance across your network. In the complex landscape of Australian franchising, thorough due diligence is crucial to making these decisions. This article outlines eight essential steps every franchisor should take to ensure a robust franchise selection process.

1. Assess Resumes and References Thoroughly

Your franchisees are the public face of your brand, so selecting the right people is crucial. Conduct a thorough review of their resumes, focusing on relevant experience, past achievements, and business savvy. Go beyond the surface – contact references to:

- verify the provided information;

- gain deeper insights into their work ethic, reliability; and

- ability to adhere to systems and processes.

As a franchisor, you face strict obligations under the Franchising Code of Conduct, including ensuring franchisees have the skills to operate the business effectively. Therefore, this step is not just advisable – it’s essential.

2. Conduct a Detailed Financial Analysis

In today’s economic climate, ensuring prospective franchisees have a stable financial foundation is more critical than ever.

You should require a full disclosure of their financial situation, including:

- assets;

- liabilities;

- income streams; and

- any existing debts.

This analysis should extend beyond the franchisee entity to include associated companies and guarantors.

Under Australian law, creditors may target your franchise system’s assets if a franchisee becomes insolvent. By proactively vetting financial health, you can mitigate this risk and protect your brand from future complications.

Continue reading this article below the form3. Secure Your Interests with Proper Legal Protection

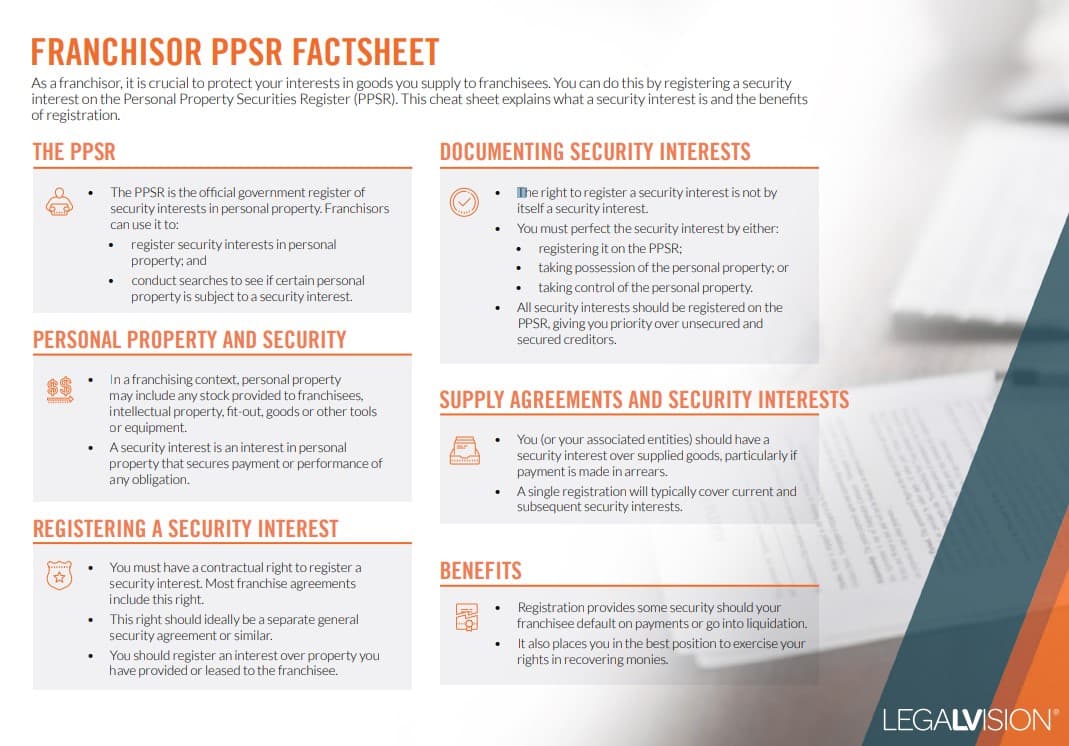

Ensuring adequate security for your interests is vital. The Personal Property Securities Act (PPSA) offers mechanisms to protect your legitimate interests against a franchisee’s property, such as equipment or stock.

Additionally, obtaining personal guarantees from franchisees and conducting thorough searches – including Personal Property Securities Register search (PPSR) checks, property title searches, ASIC searches, and bankruptcy checks – are essential.

This cheat sheet explains the PPSR, what a security interest is and the benefits of registration.

4. Leverage Online Research for Additional Insights

Never underestimate the power of a quick online search. In today’s digital age, a wealth of information is at your fingertips. Whether a Google search or a deep dive into social media profiles, online research can uncover crucial details about a candidate’s history, reputation, and character. Consider it a red flag if you spot negative media coverage, failed businesses, or unsettling online behaviour. In a landscape where brand reputation is vital, it is essential to have franchisees who align with your values and contribute positively to your brand image.

5. Conduct In-Depth Interviews

Interviewing potential franchisees might seem rudimentary, but it remains one of the most vital steps in the selection process. An interview offers insights into their motivations, understanding of the business model, and interpersonal skills.

Given consumers’ evolving expectations and heightened competition, it’s crucial that your franchisees not only grasp the operational side of the business but also excel in customer relations and brand promotion. Evaluate whether the candidate is genuinely committed and capable of delivering your brand’s value proposition consistently.

6. Request a Comprehensive Business and Marketing Plan

A well-prepared business and marketing plan could be a requirement for any potential franchisee. This document provides valuable insight into how this prospective franchisee intends to launch, operate, and grow their franchise.

The business plan should include:

- a thorough market analysis;

- financial projections; and

- a strategy for achieving sustained profitability.

The marketing plan should detail customer acquisition strategies, local area marketing initiatives, and how they intend to leverage existing networks.

7. Engage Professional Advisors

Expert advice is indispensable when reviewing financial documents, evaluating legal risks and ensuring compliance with regulatory requirements. Accountants, franchise lawyers, and other professionals can offer a level of scrutiny you might overlook.

In Australia, the complexity of franchising law demands specialist knowledge, especially with the always-evolving Franchising Code of Conduct. Engaging professionals early in the due diligence process ensures you are:

- fully informed;

- well-protected; and

- compliant with your legal obligations as a franchisor.

8. Evaluate Previous Work and Relevant Experience

It is one thing to read about a candidate’s qualifications. It is another to see them in action. Request tangible evidence of their prior work.

Remember, your franchisees are not just operators; they are brand ambassadors. Ensuring they have the right experience is key to maintaining consistent service quality across your network.

Key Takeaways

As a franchisor, the due diligence process is your first step in entering into an agreement with your prospective franchisee. These steps are designed to help you avoid common pitfalls and safeguard your brand’s integrity and reputation as you expand. By taking these proactive measures, you are in a stronger position to build a successful and sustainable franchise network.

Our experienced franchise lawyers can assist you during your due diligence as part of our LegalVision membership. You will have unlimited access to lawyers to answer your questions and draft and review your documents for a low monthly fee. Call us today on 1300 544 755 or visit our membership page.

Frequently Asked Questions

Due diligence helps franchisors assess a candidate’s financial stability, experience, and ability to operate the business successfully. This process protects the brand, ensures compliance with legal requirements, and reduces the risk of disputes or failures within the franchise network.

Franchisors should review a candidate’s assets, liabilities, income streams, and debts. Conducting searches such as Personal Property Securities Register (PPSR) checks, bankruptcy checks, and property title searches can provide further insights into their financial health.

We appreciate your feedback – your submission has been successfully received.